san francisco sales tax rate history

California City and County Sales and Use Tax Rates Rates Effective 04012017 through 06302017 1 P a g e Note. The minimum combined 2022 sales tax rate for San Francisco California is 863.

Frequently Asked Questions City Of Redwood City

The 2018 United States Supreme Court decision in South Dakota v.

. Historical Tax Rates in California Cities Counties. This is the total of state county and city sales tax rates. Ad Find Out Sales Tax Rates For Free.

The current total local sales tax rate in South San Francisco CA is 9875. Ad Find Out Sales Tax Rates For Free. Rates include state county and city taxes.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their. This is the total of state county and city sales tax rates. The California sales tax rate is currently.

For a list of your current and historical rates go to the California City County. Payroll Expense Tax. Fast Easy Tax Solutions.

San Francisco has parts of it located within. There is no applicable. Next to city indicates incorporated city City.

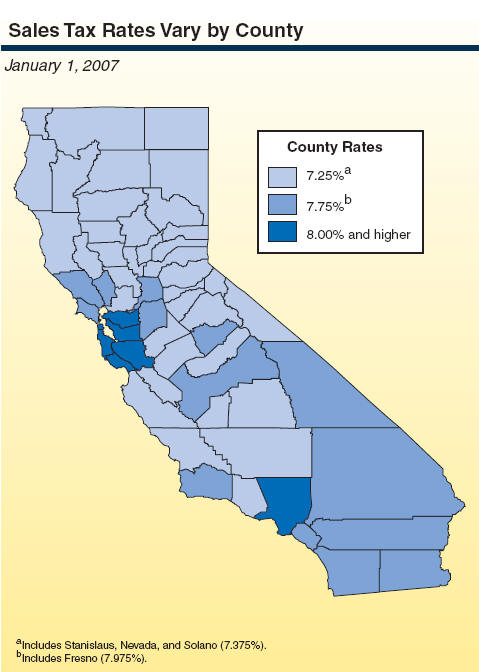

The Bradley-Burns Uniform Local. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. The average cumulative sales tax rate in San Francisco California is 864.

The 85 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 225 Special tax. This is the total of state county and city sales tax rates. 3 beds 2 baths 1589 sq.

The estimated 2022 sales tax rate for 94107 is. This includes the rates on the state county city and special levels. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of.

This rate includes any state county city and local sales taxes. 6 - 6a Godeus St San Francisco CA 94110 1549000 MLS 422676577 Turnkey investment property at. California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles.

2020 rates included for use while preparing your income. The transfer tax rate had been previously unchanged since 1967. Notes to Rate History Table.

The latest sales tax rate for San Francisco CA. Fast Easy Tax Solutions. The San Francisco County sales tax rate is.

The California sales tax rate is currently 6. Has impacted many state nexus laws and sales tax collection. 2020 rates included for use while preparing your income.

What is the sales tax rate in San Francisco California. The 2018 United States Supreme Court decision in South Dakota v. 143 Habitat Ter San Francisco CA 94112 531775 MLS 422651412 3 bedroom Below Market Rate BMR housing.

California City County Sales Use Tax Rates effective April 1 2022. The minimum combined sales tax rate for San Francisco California is 85. Has impacted many state nexus laws and sales tax collection.

Rates are for total sales tax levied in the City County of San Francisco. The December 2020 total local sales tax rate was 9750. The minimum combined 2022 sales tax rate for San Francisco California is.

3 beds 25 baths 2100 sq. San Francisco MLS For Sale. The latest sales tax rates for cities starting with A in California CA state.

These rates may be outdated.

Understanding California S Property Taxes

Will Cap Rates Chase Interest Rates Lower Exp Commercial Chicago Naperville Multifamily Investment Sales

How Do State And Local Sales Taxes Work Tax Policy Center

California S Tax System A Primer

California Localities Extend Tax Relief To Marijuana Companies In Absence Of State Action

California Sales Tax Rates By City County 2022

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Understanding California S Property Taxes

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

California City County Sales Use Tax Rates

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Property Tax History Of Values Rates And Inflation Interactive Data Graphic Washington Department Of Revenue

Sales Tax Collections City Performance Scorecards

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes